Here is where we take a deeper dive into the Texas power grid disaster and what it really means. I’ll be explaining what a report on a similar crisis 10 years ago had to say and how its recommendations were (and were not) used. I’ll also be looking at some hard data on what happened this time around, diagnosing some weakness, and mentioned some possible solutions. I won’t be discussing deregulated power markets here, as I don’t want this post to get too long and wide-ranging. There’s plenty of time to circle back to the topic, which I promise to do.

Because it is Texas, a charged presence in the public mind, there has been an avalanche of reporting. This has tended to bury the event itself in representations of it, with both overlapping and conflicting accounts. There have been some excellent reports (here is one), and there have been others. This is not a criticism. But the next point is.

Too many authors have called this year’s freeze “extremely rare” or “unprecedented” or “first time” event. As I said in the last post, and as I will show below, it was cold enough to break records, but saying nothing like it had ever happened is dead wrong. Those ignorant of history are fated to (let me get this right) fuck up big time.

At the same time, the final word on what precisely happened will only come from autopsy studies. As in the past, these are now underway in the state, including hearings, and at the Federal Energy Regulatory Commission (FERC). Such studies take months at minimum. In my experience, they are revealing, always worth doing, and often yield great recommendations. But whether the latter are adopted depends on those in power: legislators, regulators, and companies.

A decade ago, after a deep freeze shut down power for millions of Texans, an extensive report was done by FERC together with the North American Electric Reliability Corporation (NERC). In many ways, the event was uncannily similar to 2021. Outages and Curtailments during the SW Cold Weather Event of February 1-5, 2011 therefore deserves a look.

Past as Prologue and Prediction

In early 2011, Texas and New Mexico endured temperatures below 20oF for five days. In Texas, gas supply and 210 gas power plants under control of the Electric Reliability Council of Texas (ERCOT), went down or were curtailed. Blackouts affected 3.2 million customers, with smaller “load shedding” in New Mexico and Arizona. In total, 4.4 million people were affected.

ERCOT, which oversees power for 90% of Texas, had reserve capacity, but not enough. Many reserve generators were also not online when the freeze hit and failed to start. Demand for electricity and heat surged, while a third of the power plant fleet was affected by freezing of mechanical equipment, water lines, pressure sensors, and more. ERCOT imposed rolling blackouts, avoiding a complete grid collapse (catastrophic for tens of millions). This loss of power also reduced gas production, which became a significant thought not overriding factor.

Wholesale prices for immediate electricity purchase, normally around $30 per megawatt-hour (MWh) at that time, rose a hundredfold. Natural gas prices also rose dramatically. This was not evidence of a scam but is how the deregulated system in Texas is supposed to work. When there is a power crisis and a natural gas supply crisis, prices rise for both. Natural gas companies and power producing firms can make windfalls, while utilities who buy and resell electricity to end-users can lose a good deal of money but make it back in subsequent years by temporarily raising rates to certain customers (usually not people) temporarily.

Report authors were perceptive on a key point. As gas use had increased over time, more of its supply infrastructure was hooked into the grid (compressors to maintain flow in pipelines were previously powered by the gas but were now electric), making it vulnerable to outages unless given priority along with homes and hospitals. Furthermore, gas was used for power and heat—such heavy reliance on a single fuel could be a problem during spikes in demand for both these end uses. In essence, power providers were in competition with their own end-users—people.

Over-reliance on gas was thus a vulnerability to the system. In 2011, gas and coal were roughly even in the electricity they each generated (~35%-38%). But the flood of cheap gas from shale was underway, along with a rise in wind power. By 2020, coal had fallen to 18%-20% (monthly data), with gas at 53% (ERCOT Fuel Mix reports). Many have welcomed the rise of wind (~20%) and fall of coal, but gas was king more than ever.

In its conclusions, the 2011 report said “While extreme cold weather events are obviously not as common in the Southwest as elsewhere, they do occur every few years. And when they do, the cost in terms of dollars and human hardship is considerable. The question of what to do about it is not an easy one to answer, as all preventative measures entail some cost.”(10)

These words seem both reasonable and offensive. “Dollars” comes before “human hardship” and no solution is “easy” because it involves “cost.” Yet the authors are also whispering between the lines: there is something wrong with the incentives of the system.

This also emerges in the report’s recommendations. These advise better planning for extreme weather, checking temp. design limits for equipment, identifying possible failure points, ensuring that enough reserve capacity is available and able to come online, requiring that all new power plants be designed to work at low temps., with existing plants upgraded to the same capability. In short, money must be spent; reliability is the name of the game.

Crucially, the authors pointed to deep freeze events in 1983, 1989, 2003, 2006, 2008, and 2010, two of which (1983, 1989) were more severe than 2011 and knocked out power (169). That pencils out to a serious event every 4 years. Historical data from the National Weather Service shows severe cold (<20oF) came again in 2014 and 2015. Power went out in 2014 as well.

In the end, there was no doubt: such events would happen again, and again. Such extreme weather for 5 days or more wouldn’t wait for Texas and other states to be ready. Authors of the report didn’t discuss any relation between such events and climate change—e.g. weakening of the jet stream allowing polar air to flow south across Canada and into the lower 48. This will be debated for some time (dare we guess the eventual outcome?).

And Then?

FERC’s recommendations were taken seriously, at least by some. A number were adopted into a subsequent study commissioned by the Public Utility Commission of Texas (PUCT), the state regulatory body. This came in response to a bill (SB 1133) passed by the state legislature in May 2011, before the FERC report came out. The bill, written by state senator Glenn Hegar, required the PUCT to find out what went wrong, where the system was weak, and what “best practices” could be used to ensure power plants were ready for future extreme weather events.

But there was a rub. “Extreme weather” did not only mean winter cold. It also meant heat and drought during summer. Indeed, this actually took up a larger portion of the report overall, and with some reason. Much of Texas and the Southwest had been in drought conditions since 2000. Especially arid summers, in fact, came in 2010-2015. It is more than interesting, then, that a diagram comparing relative risk to relative cost shows clearly that winterizing a power plant would be far more expensive than making it operational in heat and drought it.(39)

But no requirement for any of these changes was ever put in place, either by legislation (related bills were voted down) or by rules from the PUCT. No episodes of power loss have occurred during the hottest months since the report appeared. Meanwhile, after the 2014 deep freeze, yet another study, this time by NERC, was conducted—with (you guessed it) the same overall recommendations as the 2011 FERC report.

Let’s be simple-minded for a moment. People at nearly every level of authority, in the legislature, the PUCT, gas producers, and power producers, all knew what the problems were. They also understood that these problems had a long history, that the cold conditions creating them would return, and return again, and that there were remedies to prevent their worst effects.

So why did 2021 happen? Here is where we stop being simple. We like to believe that knowledge is power. Nietzsche would say no; it’s the Wille zum Wißen, the will to know and understand. The problem here isn’t just “cost.” Remedies were never required by legislators and regulators and were never fully pursued. Yes, many companies probably didn’t want to spend the money for “infrequent” events, and nobody made them do it. There have long been cozy relations between state authorities and the companies they oversee (“regulatory capture”).

But this is only half the story. The other half comes back to ideas. The most important of these has to do with the concept of the free (unregulated) market and its unparalleled ability to match price levels with supply and demand realities. The original theory goes back to Adam Smith and the Wealth of Nations, a book of immense influence. Smith was a subtle thinker and recognized many nuances and limits in his own thinking. In this he was superior to a great many who came after and bent his ideas to argue for no government involvement in, or oversight of, any economic activity, no matter how critical to human life.

Without going further into the history of free market fundamentalism, one sees the basic anti-government view embodied in a host of policies established since conservatives came into power with the election of Ronald Reagan to the presidency in 1980. Deregulation of power markets is part of this. In Texas, it appears in a deregulated system that did not significantly change after the 2011 crisis. It 2021, it continued to reject any requirement that private companies do what is needed so that the public has secure and reliable access to electricity, fundament of daily life. Battles of the ages over powerful ideas are not confined to ivory towers in celestial realms.

Ten Years After

I’m not going to rehearse all of what happened between Feb 14 and 19, as there are now many plot summaries of quality (here is one). These are first-order interpretations. As noted, the actual details will emerge from task force studies, probably later this year. I’ll provide just a few comments for context, followed by a deeper discussion (still brief) about some crucial data.

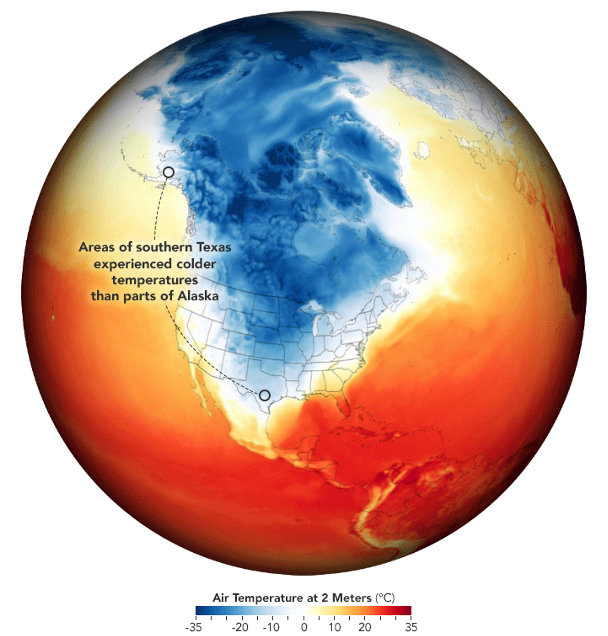

In the weeks leading up to the crisis, power demand for the ERCOT area was about 40-47 megawatt-hours (MWh). But as temperatures rapidly fell starting on Feb. 8 and remained below 20 deg.F, demand for both power and heat rose greatly. Because 60% of Texas homes have electric heat, power demand surged, eventually reaching a peak in the early morning hours of Feb. 15.

ERCOT had planned for a peak of around 67.5 Gigawatt-hours (GWh), 2 GWh above the all-time demand max of 65.5 GWh experienced in 2018. But on Feb. 15, demand went as high as 69.2 GWh, just at the time that more than 30 GW of capacity (read: 30 GWh) went offline and remained offline for the next 3.5 days. Then came a state-wide collapse in gas production—from 24 billion cubic feet per day (bcf/d) in early February to as low as 12-13 bcf on February 16. Small fractions of the total loss of electricity were due to freezing problems at several coal plants (several GW), icing problems on wind turbines (~2-3 GW), and a sensor reading that tripped the South Texas 1, one of the state’s four nuclear reactors (1.2 GW).

An important point: during the week before Feb. 15, when the call for power was rapidly growing, the vast majority of this added demand was met by natural gas. This meant, in industry terms, that Upstream (producing wells), Midstream (pipelines), and Downstream (power plants) were all involved. If any part of this chain lost significant capability, serious problems would not wait to occur. As they say in Texas, pigs get fat, hogs get slaughtered.

As it happened, every part of the chain broke. Wells were blocked by ice and hydrates. Processing units (separating gas from liquids) suffered mechanical problems in the subfreezing temps. Pipelines had ice/hydrate blockage and pressure drops, plus compressor failures (compressors move the gas in a pipeline). And power plants saw their equipment malfunction and pipes freeze. Then the blackouts came, knocking still more equipment offline.

The mess in Texas (bad as an acre of snakes, in Texanese) continued for 4 days at declining levels for electricity. Blackouts did not roll very much, meaning they didn’t shift from one district to another to reduce the pain. More than a few areas were power-less for 3-4 days. The lucky ones lived close to hospitals and other facilities that did get continuous power. Reasons are not entirely clear at this point. But the effects are. Heat, water, food, and faith in authority were all greatly reduced.

As in 2011, natural gas and electricity prices soared above the clouds (from a few dollars per million BTUs to hundreds for gas, and from around $26 per MWh to as high as $9,000, the absolute maximum allowed). Once again, gas suppliers and power producers had windfalls, while utilities/electricity resellers lost many millions (unless they owned portions of gas/power companies in other affected states).

Thousands of Texans were hit with huge power bills, well into the $thousands, for just a few days of electricity. As in 2011, this was not a rip-off. It happened because these people get their power from an electricity reseller that passes on wholesale prices to consumers (most utilities and resellers buy wholesale and sell at fixed rates, which, for a majority of the year, are a bit higher than wholesale). These consumers pay especially low rates in normal times, but then get hit with a price locomotive in a crisis. It doesn’t only happen in Texas; it happened in California, too, with the Enron debacle.

But let’s be serious. There is a kind of scam here, the American “innovation” of: “Pay only $5 a month for the first 6 months, cancel anytime!” Exploiting basic human psychology works—or, full honesty, exploiting the circumstances of lower income people that include minorities, the less educated, and the elderly—is a time-honored approach to profit. In a more ethical and sane system, this kind of option for buying electricity would not be allowed. There are, after all, laws against harming yourself and your family. But free market fundamentalism doesn’t recognize such minor considerations: human beings are purely rational economic actors.

Data Discussion

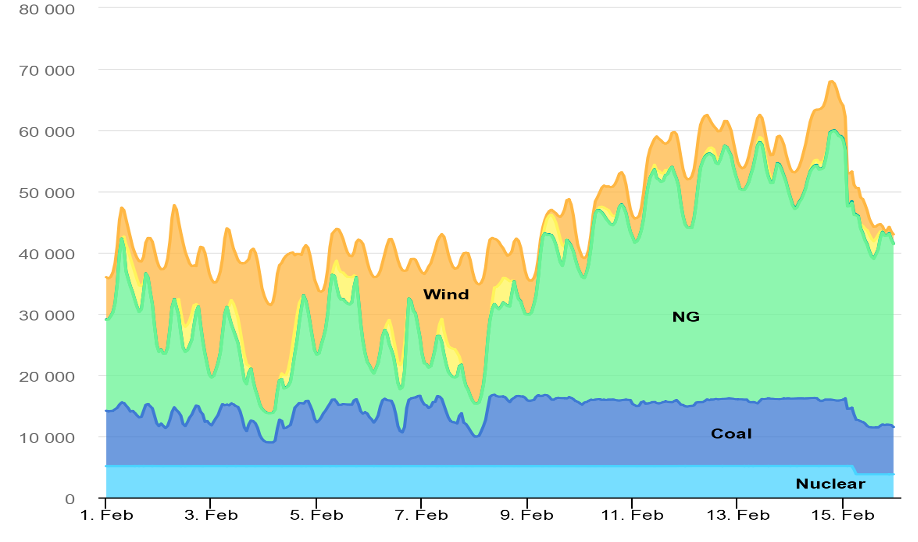

Below is an interesting and informative graph. It shows the power generated by each different source between Feb. 1-16. It’s borrowed from the International Energy Agency (IEA) and based on ERCOT’s own numbers. The vertical axis shows electricity in megawatts.

Here are some observations:

Wind provided a lot of power (10-20 GW) until February 8, when the deep freeze began. Turbines did not have heating equipment (as in Iowa or North Dakota), so a number iced up and shut down. Wind, however, is a major source of power, but a highly variable one.

During Feb. 1-8, both natural gas and coal compensated for wind/solar’s high variability. From Feb. 9, as demand began to surge, coal was held to i max output, and gas alone filled the gap. From then on, if the gas side had a problem, the whole power system did.

Such happened on Feb. 15—power from gas plants fell from about 6 GW (60,000 MW) to 4 GW, an entire third. The cold had lasted long enough to create serious problems not only at power plants but in gas supply to those plants. The loss in power from wind was significant, but hardly compares with that from natural gas.

The graph suggests two big vulnerabilities: 1) the need to compensate for large fluctuations in wind power; 2) the reliance for this on one fuel that has multiple sources of demand (mainly power and heat). These indicate the situation will get worse as coal falls further and more wind is added, unless other changes are made.

Besides full-scale winterization, there are some solutions that the graph highlights. One is to require large amounts of (winterized) gas storage that power plants can draw on in crisis situations. Others include building advanced, dispatchable nuclear power, possibly on a distributed basis. Another is to install massive amounts of electricity storage. And yet another, partial solution, is to use high-voltage DC lines to connect with the rest of the national grid.

Among these “solutions,” only the last is relatively cheap. The first idea can be done fairly quickly with existing technology, while the next two have not yet been fully demonstrated technologically or financially, holding out great promise for the future.

Solar-generated electricity, at a large-scale, could mitigate the situation if accompanied by enough storage to counteract the added variability. This would apply both to utility-scale installations or local-scale on homes and other buildings to reduce their dependence on the grid.

Other options can emerge if smart grid technology is comprehensively introduced and if real changes to the electricity market are made. Either of these will require time and even if agreed upon, will not be complete before the next freeze.

The Future was Then

We come to the final question of what this crisis reveals. I can only point out a few answers, but they are far from trivial.

1. Texas is struggling to deal with two probable dimensions of climate change. One of these involves a megadrought—drought conditions persisting for a decade or longer, which have affected a sizeable portion of the Southwest. The other is winter conditions with subzero temps concentrated over a span of days in January and February.

2. State political leaders have yet to accept and deal rationally with this reality. Because so many people (voters) were affected in 2021, some changes may be made to the system of power generation and supply. It is unlikely, however, given the traditional mindset of Texas conservatives, that this will be sufficient to avoid serious problems in the future.

3. Texas is therefore emblematic of most US states, including those who pride themselves in being climate savvy. The Earth is ahead of us; we have spent more time bickering and debating than catching up. The imbalance between our knowledge of what is happening and what is being done to mitigate it is astonishing.

4. The Texas crisis makes plain that electricity is not accurately conceived as a commodity, like shoes or pizza. It also shouldn’t be so cheap that incentives are weakened to ensure its full reliability under all foreseeable conditions. Bad things are likely to happen when people are viewed by authorities as merely carriers of money or future votes.

5. The supply of power in every nation on Earth is an immediate national security matter. As more highly digitized systems (smart grid), supported increasingly by AI, come to control different parts of the grid, will each nation have the foresight to pay for what it takes to protect them against cyberassaults? To win a war in the coming future may only require the destruction of an enemies social fabric.

Hopefully you’ve had enough of Texas for now. We’ll be back before long, because the Permian Basin is too important to leave on ice. Next post: the world, part 2.